What Are 1099s and Do I Need to File Them?

el presidente2019-12-17T15:49:36+00:00Taxpayers dread receiving 1099s and as a business, you might not enjoy sending them out. But why deal with them all together? Because the IRS loves 1099s…and requires them. They report taxpayer income to the IRS. Here’s what you need to know about W-9s and 1099s.

What are W-9s and 1099s?

What are W-9s? IRS forms that request taxpayer ID numbers and business certification from business service vendors. What the vendor declares on this form will determine whether you must issue a 1099

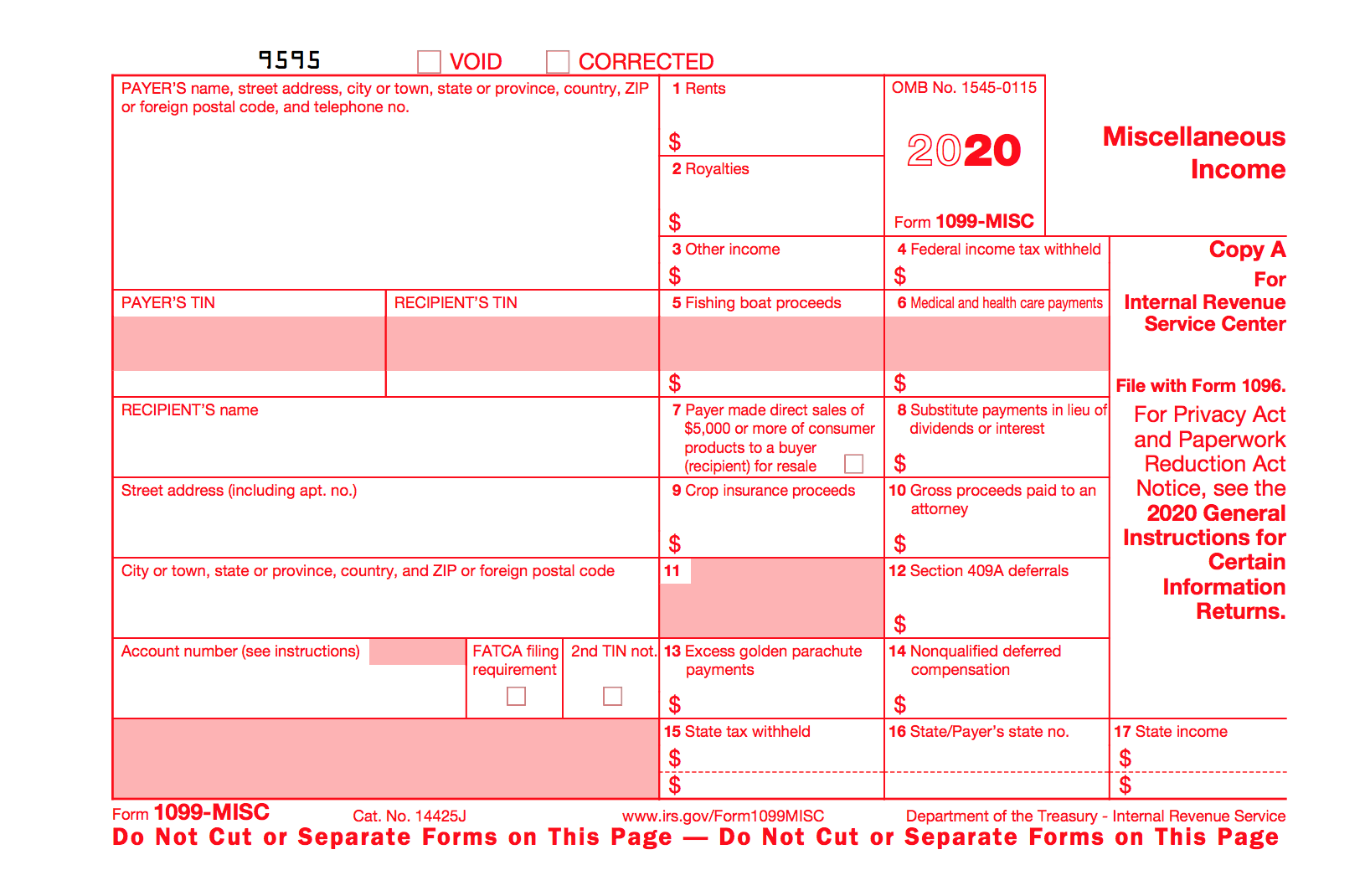

What are 1099s? IRS forms issued to service vendors each year that document the vendor’s miscellaneous income to the IRS

Rules on sending 1099s: Generally, you are required to send 1099 MISC forms to people and vendors you have paid for business services by cash or check. There is a threshold of $600. You must have paid a vendor for services, $600 or more over the course of the year, in order to fall under this requirement. You do not need to send a 1099 to a vendor that is incorporated. This exemption does not apply to attorney services.

Do I need to File 1099s?

You Don’t Think 1099s Apply To You….and You Couldn’t be More Wrong! Why do we care? We’re trying to help you avoid big penalties. The IRS was wise to focus on 1099s for their crack down effort to improve proper reporting of taxable income. You don’t even realize how non compliant you are – perfect! says the IRS. What a great place to grab $500 in penalties.

The #1 thing you got wrong: 1099s are only for contract laborers. Many businesses assume that if they don’t have contract laborers, 1099s simply don’t apply to them. 1099s must be issued to those whom you pay for business rent, to those whom you pay for legal fees, to anyone whom you paid for a business service, not simply contract labor. Those who are incorporated are exempt (except for attorneys), but how do you prove that they are incorporated? You collect their W-9 form.

The #2 thing you got wrong: you can collect W-9 forms in January. You have 20 business days to send 1099s to eligible vendors, make corrections, and file them to the IRS….AND you think you can start asking vendors for W-9s on January 11? It’s simply not feasible with the time limitations. Start to collect W-9s as soon as you pay new service vendors.

What Happens if I don’t File my 1099-MISC?

Even if you don’t receive the 1099-MISC form, you are still responsible for paying the taxes you owe. It is a good idea to reach out to the company. They may have filed the 1099 to the IRS but it may not have reached you. If this happens the IRS will send you a bill saying you owe taxes on the income. You can get a surprise bill years after the fact. If the 1099 form did not come, file it as miscellaneous income. A tax professional can help you with the process.

Urban Myths Surrounding 1099s

“LLCs are corporations, so I do not need to issue a 1099” This is not true. In fact most LLCs are not corporations. But they can be. How do you know? Request a W-9 from the vendor.

“My contract vendor told me he is incorporated so I don’t need to ask for a W-9” This is not true. In an audit the IRS will request W-9 documentation proof from you as to why you did not issue vendor 1099s

“I asked my vendor for a W-9 and they refused. So I’m covered with the IRS because I asked for one” This is not true. The IRS says it is YOUR responsibility to get a completed W-9 from your vendor. How would you make sure you get one? Request it before you pay the vendor.

“Rent is not something I have to send a 1099 for” This is not true. The IRS even has a special box on their 1099 for business rents.

1099 Example for Small Business Owners

Let’s say you are a website developer and you need a logo designed for a client. You hire a graphic designer to come in and help you design the perfect logo for your client.

The graphic designer works solo, owning a sole-proprietorship business. The contractor designs a beautiful logo that looks fantastic. She bills your company $1000 for the logo.

It is now up to you to send the contractor a Form 1099-MISC stating the service and the amount you paid her. You will also file the Form 1099-MISC to the IRS before the Form 1099-MISC deadline.

Ultimately all 1099 compliance is the responsibility of business owners. Your accounting professionals are here to assist you, but you are the key to making the process work. Make sure that you understand both 1099 guidelines and your bookkeeper/ accountant’s procedures to help keep you compliant and avoid issues.

Resources

More on Form W-9 request for Taxpayer ID Number and Certification https://www.irs.gov/pub/irs-pdf/iw9.pdf

More on Form 1099 report of Taxpayer Miscellaneous Income https://www.irs.gov/pub/irs-pdf/i1099msc.pdf

You Might Like:

How Small Businesses Can Compete With Big Brands

Recent news has been calling out big tech such as Facebook for it’s ethical choices in the face of a whistleblower who ousted the company for repeatedly choosing profit over people and buying out [...]

Disaster Prep Your Business

Fires, floods, hurricanes, earthquakes, and extreme weather are threats we are experiencing more regularly due to climate change. This is getting close to home. We have been watching the Caldor fire ravage through California [...]

Celebrate the Wins!

We constantly talk about how businesses and entrepreneurs can be better. This includes how to run your business better, how to run your accounting better, how to have more motivation, and more. We rarely [...]

The Startup End Game

The hardest part about starting a business is starting. We have talked a lot about how to make the leap into entrepreneurship but we rarely talk about the end game. If you haven't also [...]

How Biden’s Proposed Tax Bill Will Affect Small Businesses

The new presidential administration has proposed a large new tax bill to offset other priorities such as improving infrastructure, funding the American Rescue Plan, combating employment inequality and tackling climate change. These are expected [...]

Q&A With A Founder

At Singletrack Accounting, we love hearing from happy small business owners that our team has saved time, headaches, and the stress of the dreaded tax filing season. In addition, as entrepreneurs ourselves, we enjoy [...]

I am acutely aware of the realtor frustrations in resort towns. Not only am I married to one, but I’ve also worked professionally with some of the top Realtors in my ski town as well as the state. Realtors are my clients and friends. I’ve attended more Real Estate conventions than Accounting conventions. I have a good pulse on running a Real Estate business in today’s world and here is what I see: you are facing challenges from everywhere.

I am acutely aware of the realtor frustrations in resort towns. Not only am I married to one, but I’ve also worked professionally with some of the top Realtors in my ski town as well as the state. Realtors are my clients and friends. I’ve attended more Real Estate conventions than Accounting conventions. I have a good pulse on running a Real Estate business in today’s world and here is what I see: you are facing challenges from everywhere. Zillow, Redfin, and about a hundred other business are launching industry disruptive technology services. You can’t even keep up your

Zillow, Redfin, and about a hundred other business are launching industry disruptive technology services. You can’t even keep up your